nassau county income tax rate

For the 2020 tax year this is a 37 tax rate. The W-4 is designed to withhold toward taxes a little more.

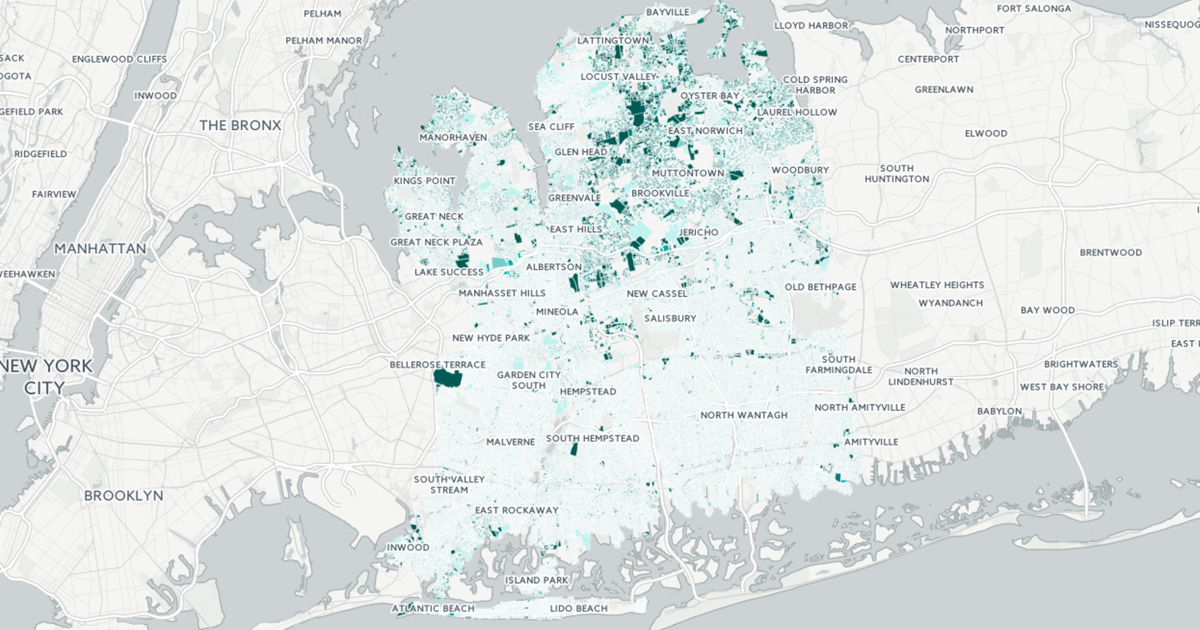

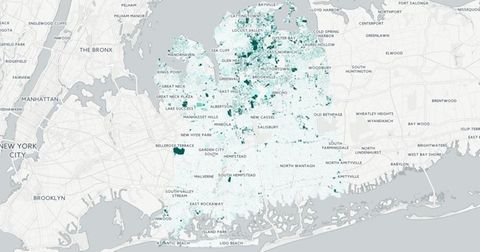

New York S Broken Property Assessment Regime City Journal

The average yearly property tax paid by Nassau County residents amounts to about 239 of their yearly income.

. The average total salary of Associate Directors in Nassau County NY is 79000year based on 26 tax returns from TurboTax customers who reported their occupation as associate directors in. The US average is 46. A county -wide sales tax rate of 425 is applicable to localities in Nassau County in addition to the 4 New York sales tax.

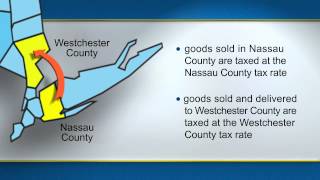

Purchases of tangible personal property made in other states by persons or business entities. What states have no sales tax on clothing. This is the total of state and county sales tax rates.

As for zip codes there are around 88 of them. The median Nassau County tax bill was 14872 in 2019. When I Nassau County Property Tax Rates.

There are eight tax brackets that vary based on income level and filing status. That said 50 states income ta. Purchases above 110 are subject to a 45 NYC Sales Tax and a 4 NY State Sales Tax.

A full list of these can be found below. The New York state sales tax rate is currently. The average yearly property tax paid by Nassau County residents amounts to about 826 of their yearly income.

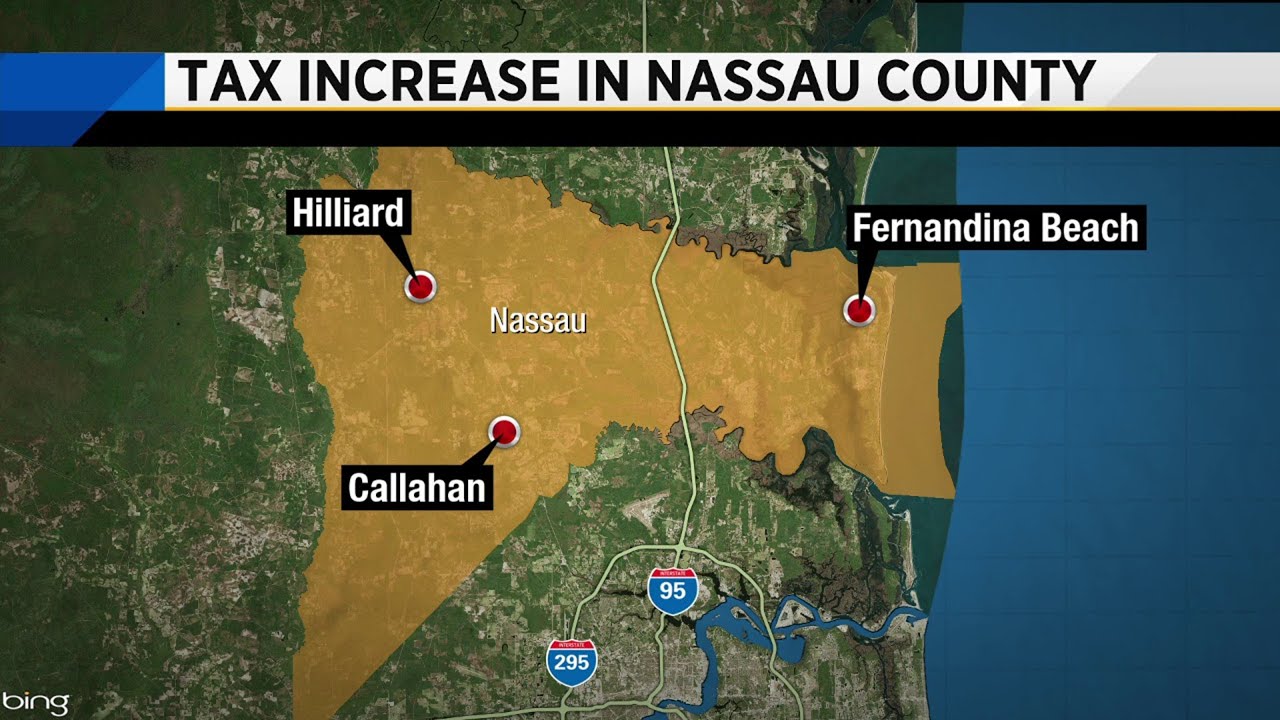

Does Nassau County have income tax. Municipalities None 6 sales and use tax applies to. The Nassau County New York sales tax is 863 consisting of 400 New York state sales tax and 463 Nassau County local sales taxesThe local sales tax consists of a 425 county.

Nassau County is ranked 4th of the 3143 counties for property taxes as a. Tax Rates for Nassau County The Income Tax Rate for Nassau County is 65. Does Nassau County have income tax.

Tax Rates By City in Nassau County New York. Nassau County 1 local option. The US average is 46.

Does Nassau County have income tax. Future job growth over the next ten years is predicted to be 283 which is lower than the US average of 335. Tax Rates for Nassau County.

Nassau County is located in New York and contains around 63 cities towns and other locations. A Cost Approach as well is primarily a commercial real estate. Without accounting for exemptions the Nassau property tax rate is 515 per 1000 of full value in 2021 plus town.

Taxes on one million dollars of earned income will fall within the highest income bracket mandated by the federal government. - The Sales Tax Rate for Nassau County is. Tax Rates for Nassau County The Income Tax Rate for Nassau County is 65.

The minimum combined 2022 sales tax rate for Nassau County New York is. Nassau County is ranked 1060th of the 3143 counties for property taxes as a. Clothing and footwear under 110 are exempt from New York City and NY State Sales Tax.

The Nassau County Florida sales tax is 700 consisting of 600 Florida state sales tax and 100 Nassau County local sales taxesThe local sales tax consists of a 100 county sales. You are going to have a NJ tax bill at the tax rate for 100000 income on a large part of that 20000 of interest and dividends. The 1 percentage point cut to basic rate income tax - paid on income earned between 12571 and 50270 - was first announced by Rishi Sunak then brought forward a year by.

New York States progressive income tax system is structured similarly to the federal income tax system. The US average is 46. What is the sales tax rate for Suffolk NY.

This is the amount you pay to the state government based on the income you make as opposed to. What is the tax rate in Long Island. The Income Approach is based upon how much rental cash flow likely would be produced from income-generating real estate.

Tax Rates for Nassau County The Income Tax Rate for Nassau County is 65.

Make Sure That Nassau County S Data On Your Property Agrees With Reality

New Yorkers Paid Less In Federal Taxes In First Year Of New Federal Tax Law Empire Center For Public Policy

Economy In Nassau County New York

Nys Sales Tax Rates And Jurisdictions Youtube

What To Know Before Moving To Long Island

Property Taxes In Nassau County Suffolk County

Nassau County Ny Property Tax Search And Records Propertyshark

Us New York Implements New Tax Rates Kpmg Global

Economy In Nassau County New York

Tax Exemption Saves Owners Of New Homes In Nassau County

6 Reasons Why Nassau County Is The Place To Move Tributary

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

New York Property Owners Getting Rebate Checks Months Early

Nassau County S Property Tax Game The Winners And Losers

Property Taxes Going Up In Nassau County Is Gas Tax Next